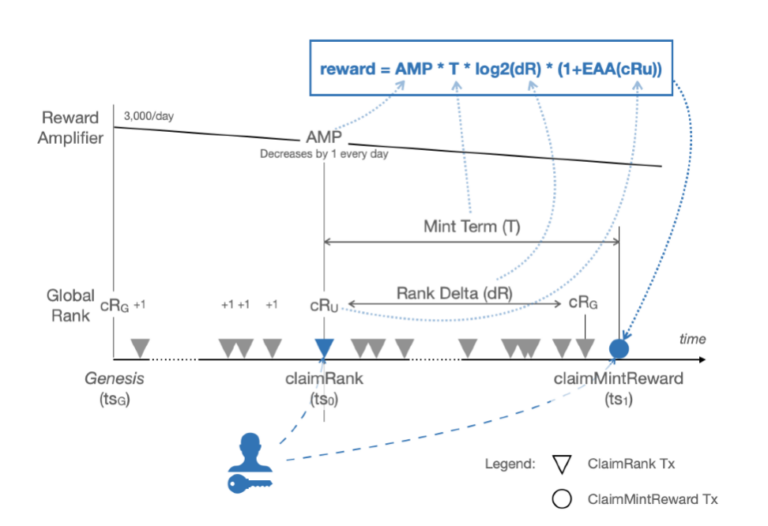

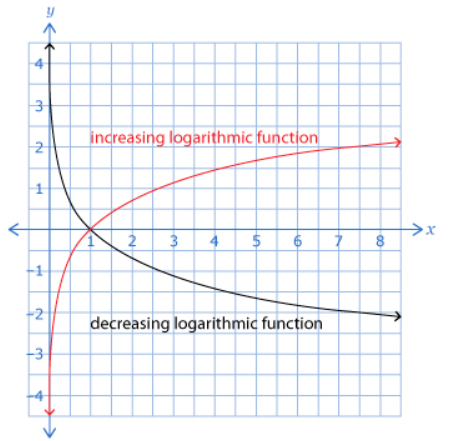

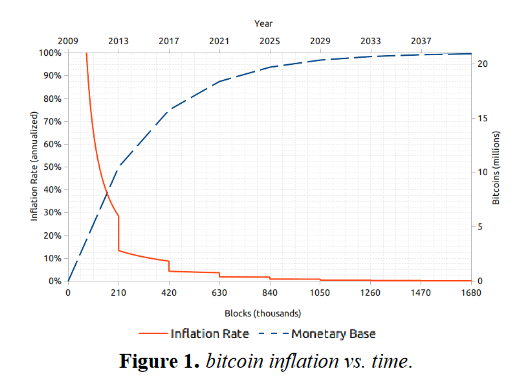

XEN’s monetary policy involves a decreasing rate of new token issuance over time, leading to a logarithmic decrease in the inflation rate. This phenomenon is referred to as disinflation.

In the early stages of XEN, where new tokens are generated through minting, the rate of token creation might be relatively high, but the rate of token generation is diminishing daily for little over eight years.

This mechanism results in a gradual reduction of the inflation rate until it reaches a plateau of a 2% annual rate.

This could potentially create scarcity over time, as the rate at which new tokens are introduced into the market slows down. Scarcity can have a positive impact on prices because limited supply can increase demand, leading to potential price appreciation.

An increasing logarithmic function of total supply means that the overall supply of tokens is increasing, following a logarithmic pattern. Larger increases in supply happen early on, but the rate of increase slows down as time goes on. This aligns with the concept of diminishing returns – as the token supply increases, each additional increment has a relatively smaller impact on the overall supply.

This has an interesting implication for XEN. The combination of decreasing inflation and increasing supply of XEN might lead to a scenario where the token becomes more scarce over time. Scarcity, as mentioned earlier, tends to drive up demand, which can potentially lead to price appreciation.

Bitcoin has a similar monetary model rooted in a decreasing inflation rate and increasing supply, which eventually stops.

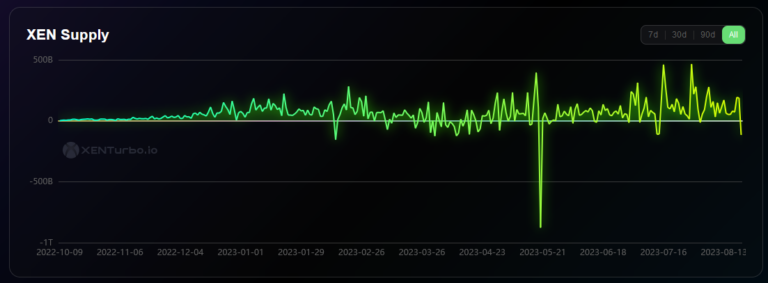

This is true only if there is no token burn, but XEN has a burn function that is used by many projects like DBXen and XENFTs, Fenix, XEN Knights, Xendoge, or XEN Game. Token burn decreases the total supply, contributing to disinflation and eventually leading to deflation. Let’s explore the potential impact of token burning in three different scenarios:

- Token burning lower than inflation rate:

If the rate of XEN destruction is consistently lower than the inflation rate, the net effect on supply will still be an increase over time. However, the increasing supply might be moderated compared to a scenario without token destruction. This could impact the scarcity factor, potentially slowing down the rate of price appreciation. Adoption might follow a similar trajectory as before, with an initial phase of excitement and adoption driven by the combination of scarcity anticipation and the potential for price appreciation.

- Token burning higher than inflation rate:

If the rate of XEN burn is consistently higher than the inflation rate, the net effect on supply could be a decrease over time. This scenario could lead to more rapid scarcity development and potentially stronger price appreciation. Users might be motivated to acquire and hold the token in anticipation of ongoing scarcity and value increase. The adoption curve could be influenced by the faster perceived value appreciation, attracting users who want to benefit from the potential price growth.

- Variable token destruction:

If the token destruction rate varies, sometimes being lower and sometimes being higher than the inflation rate, the impact on price and adoption could be dynamic and unpredictable. Periods of higher destruction could lead to price spikes and increased adoption, while periods of lower destruction might result in more subdued price growth and adoption. The overall effect would depend on the balance between destruction and inflation during different phases.

The interaction between these variables is complex, and the outcomes will vary significantly based on XEN’s utility, the market sentiment, and the behavior of participants. When we add the gas cost to the equation the entire scenario further complicates the dynamics of price and adoption. This makes XEN only more interesting and worth diving into.

We’ve written here about the cost of production, liquidity, and accessibility of XEN for further subject exploration.