Since its launch on October 8, XEN Crypto has caused headache to each of the 10 chains it sits on. Its stronger form, the XENFTs have just caused Polygon gas to jump up, creating disruption, failed transactions, and delayed block inclusion. The recent deployment of XENFTs on the BSC chain was successful and led to the burning of over 20% of the bXEN. XEN Crypto on Ethereum continues to burn and is at 20%.

XENFTs launch on Polygon

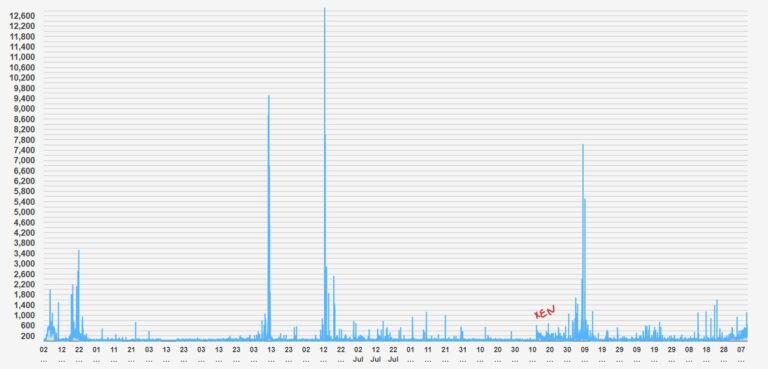

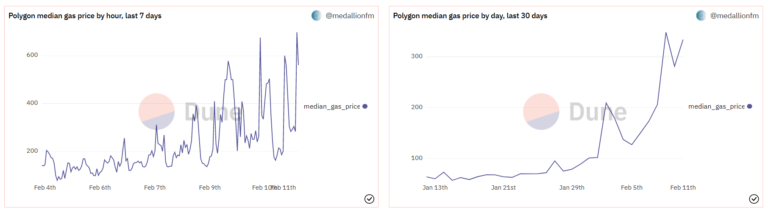

The XEN Torrent protocol with XENFTs was launched on Polygon on February 11. The countdown to the launch was set two days before, but the contract deployment had major hiccups. The Polygon network gas fee exceeded the 2100 gas level, and there were difficulties with publishing the contract.

0x1Ac17FFB8456525BfF46870bba7Ed8772ba063a5 XENFT deployment successful, now the web app part

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 11, 2023

Since XEN Crypto’s launch on Polygon, the average gas fees have been higher due to higher network usage. The XEN minting activity was also higher in recent weeks in preparation for the XENFTs launch and the mXEN burn requirement.

The Fair Crypto Team made a mistake in the XEN burn settings for Xunicorns. Instead of 10 billion mXEN for the highest Apex, the burn was set to 10 million.

OK, this was a minor disaster, a lot of Transactions failed due to Polygon freaking out and we pushed wrote branch of the code, that allowed Xunicorns being minted with only 10M XEN. We are relaunching in about 10 mins. Sorry guys.

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 11, 2023

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 11, 2023

Jack Levin decided to relaunch the smart contract right after with the requirement to burn 10 billion mXEN to mint a Xunicorn from the Apex category of XENFTs.

The Xunicorns and other XENFTs from the first collection have still the same mint capability, and they’re still eligible for the XN airdrop on Devnet and the future X1 chain testnet.

Why did Polygon experience disruption

Polygon transactions can sometimes be slow because of things like network congestion, network latency, and the number of transactions being processed on the network.

- Network congestion: Like any blockchain network, Polygon can experience periods of high traffic, causing the network to become congested and slowing down the processing of transactions.

- Network latency: The time it takes for a transaction to be processed can also be affected by the latency of the network, which is the time it takes for a transaction to travel from one node to another.

- Number of transactions: The number of transactions being processed on the network can also have an impact on the speed of transactions, as the network may become congested if a high volume of transactions are being processed at the same time.

The Polygon network underwent a hard fork in January 2023 to upgrade its infrastructure and improve its scalability and security, as well as introduce new features and improvements to the overall user experience. The hard fork introduced optimizations to the network’s consensus mechanism and the way transactions are processed, which aim to increase the overall speed of transactions. This had to be achieved by reducing the time it takes for transactions to be confirmed and by improving the parallel processing of transactions through sharding. The hard fork introduced also a number of security improvements to help protect the network against potential attacks and a more user-friendly interface, improved support for decentralized applications, and more.

Overall, the January 2023 hard fork of the Polygon network was an important milestone in the development of the platform, but it seems like it didn’t achieve fully the goal. The XENFTs launch showed that network can’t stand the load of the high traffic and becomes clunky.

Jack Levin said : “I was testing XEN limit approval transactions and those were failing also. Unfortunately there is no way to load test the chain before the launch.”

https://twitter.com/mrJackLevin/status/1624425239747919872?s=20&t=1qq2cgUmOScnaIY2IVwW0g

The former Google engineer recently announced plans to build the X1 blockchain, which will be based on the Polygon Edge protocol and feature one-second transaction throughput, parallel transaction processing, and zk-proofs.

“We are using Polygon Edge without EIP 1559 with custom gas control. We also can make adjustments to code by analyzing what happened to Polygon. We know that Ethereum and BSC did better, likely due to better TX queueing management” said Mr. Levin.

The XENFT experience is going to provide valuable feedback for both the Polygon team and the Fair Crypto Foundation.

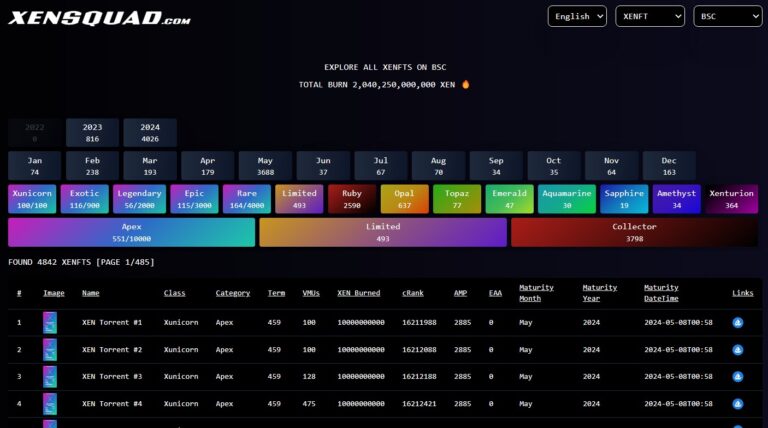

XENFTs on the BSC chain

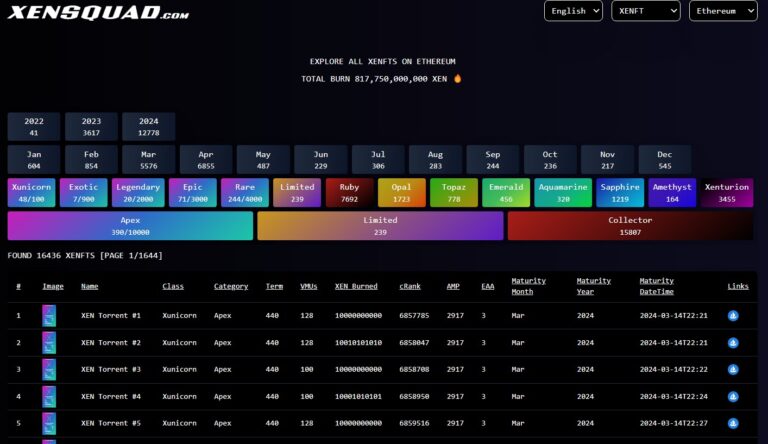

The XENFTs launch on the BSC chain was on February 3 and it led to burning almost 20% of the total supply of bXEN. The burn is ongoing, and it will never end. The smart contract was deployed with a burn requirement of 10 million for the Limited Category of XENFTs, rather than 250 million as on Ethereum. All 100 Xunicorns have been minted within the first 3 hours.

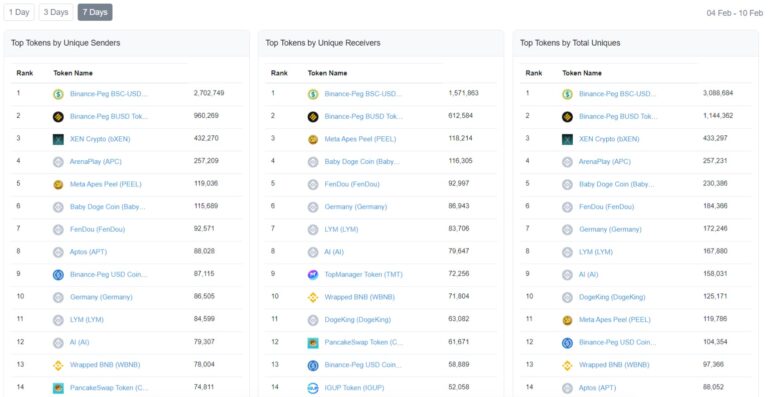

XEN torrent is currently at 56th position of the top ERC-721 tokens on BSC. At the time of writing, there are 4809 XENFTs. bXEN has been among the top tokens since its October launch and continues on this track.

XENFTs on Ethereum

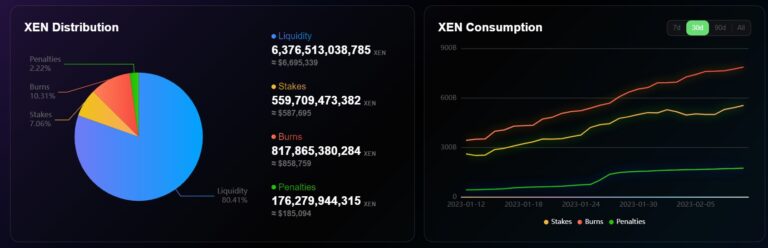

XENFTs launched on Ethereum at the end of December. Since then, they have contributed to the consumption of 20% of the XEN Crypto supply. XENFTs alone burned 817,750,000,000 XEN or 11% of the total supply. Staking and Staking XENFTs burned 7% and 2% was never created due to penalties.