On June 4, Jack Levin, the founder of XEN Crypto and the man behind the VMPX BRC-20 token, published the X1 Litepaper. One of the main aspects of X1 is to break the divide between the EVM ecosystem and Bitcoin with the help of a decentralized bridge while providing the XEN community with a permissionless and high-performance chain. The Litepaper outlines the distribution of the XN native coin and the VMPX BRC-20 bridge token. X1 is set to be a so-called community-owned chain entirely based on open source code, with no venture capital investment or allocation to any designated party. Only with this unique approach committed to decentralization, censorship resistance, fairness, transparency, and interoperability can X1 revolutionize the crypto industry.

X1 Blockchain: The Foundation of Innovation

X1 blockchain emerges as a state-of-the-art Layer1 EVM blockchain built on the same First Principles XEN Crypto was built on.

By leveraging the battle-tested and open source technology of Polygon to ensure maximum freedom, flexibility, security, and fast transaction execution, X1 aims to connect the Bitcoin and EVM ecosystems and enable trustless swaps between any BRC-20/Ordinals and ERC-20/721/1155 digital assets.

The confluence of the two biggest ecosystems is set to usher in a new era of collaboration and technological possibilities for users and developers alike.

The XEN ecosystem from 10 chains converges on X1, and, with no external funding, Bitcoin integration is indispensable to ensure fast growth through access to new users, developers, and a $500 billion market cap.

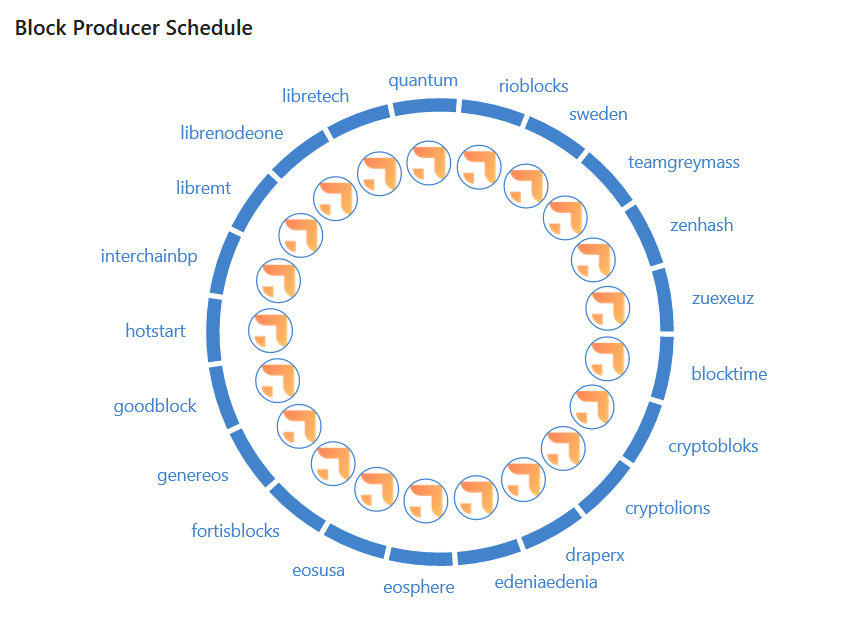

X1 is going to adopt Delegated Proof of Stake (DPoS) to achieve consensus and produce 1s blocks and 1400 transactions per second. The validators will be able to freely participate upon staking XN tokens and/or securing the required number of votes from the community.

The Bitcoin-Ethereum-X1 bridge

The bridge between Bitcoin, Ethereum, and X1, powered by the VMPX token, revolutionizes cross-chain interoperability and opens up a world of opportunities for users and developers.

It ensures that users can seamlessly transfer assets between the two chains without the need for intermediaries or centralized exchanges.

It uses Libre chain and pNetwork to carry out bridge operations. Libre validators verify the cross-chain asset swaps and aim to guarantee the 1:1 peg with the underlying asset. Libre is operated by a total of 21 Block Producers validating transactions.

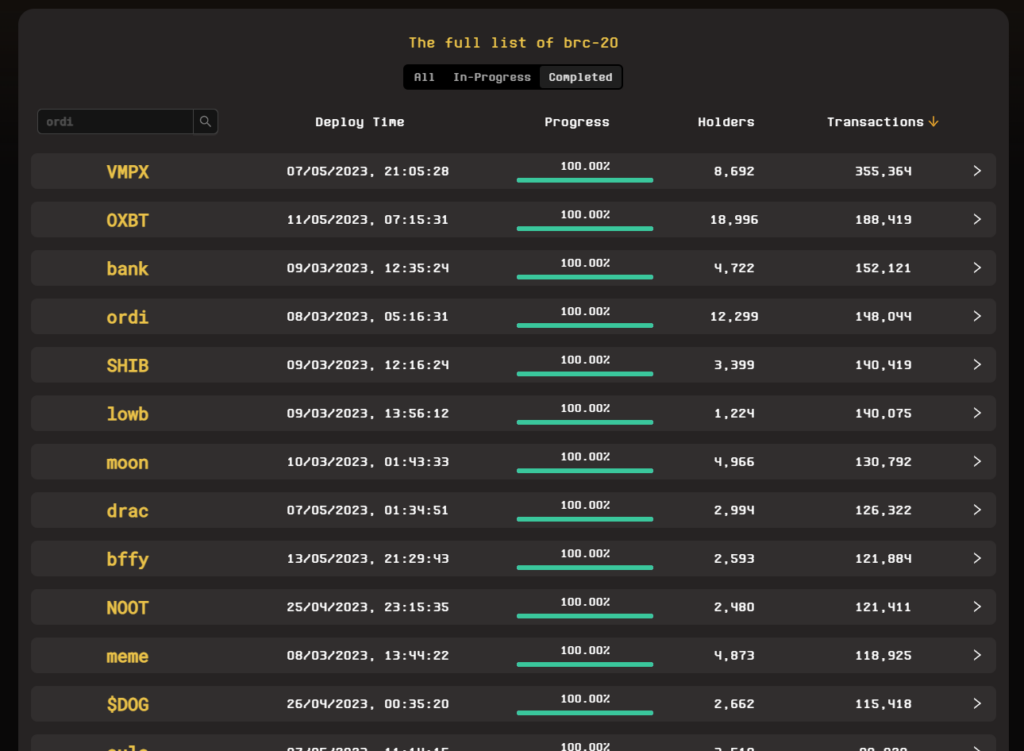

The VMPX token is a fairly-launched BRC-20 token on Bitcoin created by Mr. Jack Levin. Its supply is capped at 108,624,000, which is a so-called vampire number.

On July 4, an equivalent amount of VMPX will be launched on Ethereum as an ERC-20 token, and everyone can participate in a mint that is going to last around 8–12 hours. Participants can free mint from 200 to 39,000 per transaction; however, there’s a gas fee to pay, which is going to be very high considering the short lifespan of the mint and a predictably large number of users.

The same mint on Bitcoin caused network congestion for days, unprecedented transaction fees, and disrupted BTC withdrawals on Binance.

The launch of VMPX on Ethereum is likely to halt all non-VMPX transactions, leaving a historical mark on the gas chart.

XEN Crypto’s launch on October 8, 2022, left a mark on Ethereum’s supply, making it deflationary for the first time.

In the same way as VMPX forced the Bitcoin community to upgrade their hardware to prepare for larger adoption and adapt to changes, also on Ethereum, the XEN community is going to demonstrate its force to make a statement that changes are coming and that the walls between the chains are about to fall.

Users can already buy the BRC-20 VMPX on unisat.io. It’s enough to download the wallet and fund a taproot address with BTC.

Others can mint VMPX ERC-20 and pay the gas fee. Ethereum gas fees are much higher than Bitcoin fees, and the mint will create a spike, bringing the cost of the mint to very high levels.

Gas cost to mint XEN was a crucial factor in establishing the price floor for the token, so it’s possible that the high gas cost of VMPX will be a precursor to setting the floor price for VMPX and, in consequence, that of XN.

Better 🙂 https://t.co/DylwMoSapd pic.twitter.com/BsdewL8YrE

— Jack Levin (@mrJackLevin) May 8, 2023

Liquidity provision

To ensure liquidity for the bridge, holders of VMPX tokens can participate in staking by providing liquidity between the Bitcoin, Ethereum, and X1 chains on the Libre network. By staking one or both VMPX tokens into the bridge liquidity pool, users contribute to the seamless functioning of the bridge and earn yield as a reward. The yield is paid out in VMPX fees. Considering that the bridge is connecting the two most liquid chains with the most user activity, the fees generated from liquidity provision are going to be a very good source of passive income.

XN coin distribution

XN is the native coin of the X1 chain, capped at 1,000,000,000 coins and used as gas for transactions, rewards for validators, and for establishing consensus and security. The validators are rewarded with XN for each successfully produced block, which creates inflation; however, each transaction fee burns XN, which reduces inflation and, in favorable conditions, creates deflation. The supply is thus inflationary, with a disinflationary or deflationary mechanism in place that preserves the value of the coin while ensuring economic efficiency and continuity of network operations.

The distribution of XN is designed to follow the Bitcoin model, where no pre-allocation is granted to anyone and the supply starts at zero with a fair system of participation and coin generation. This distribution model protects the network from regulatory attacks, ensures the broadest possible distribution, and upholds the ethos of fairness. The participants can generate XN in three ways, each with a 333 million XN allocation:

- By minting and burning XEN on 11 EVM chains. The burn is possible through participation in different projects that utilize the XEN burn function. The amount of XN will be in proportion to the quantity of burend XEN and the XEN market cap ratio between different networks.

- By burning XEN in a daily auction on Ethereum. Each day, 1,000,000 XN tokens will be released to the pool, and users can get a share of this pool by depositing XEN into the contract and burning it for XN. The auction will last 333 days for a total allocation of 333,000,000 XN. It’s possible to select the preferred burn period ahead of time. It can be the current period or any future period up until the final one.

- By converting VMPX to XN in a 1:3 ratio. These XN coins can then be used to provide liquidity for the Bitcoin-Ethereum-X1 bridge.

Listen to @mrJackLevin talking about XEN, VMPX, XN and the X1 Litepaper. Voice your concerns and ask questions in the comments below so they can be addressed next time Jack is speaking pic.twitter.com/CuS9XH4kQ6

— ⓧ XEN Crypto | News & Updates (@Xencryptoio) June 10, 2023

Final note

The X1 Litepaper created some controversy at first amongst the XEN community; however, nothing is set in stone yet. The Litepaper’s disclaimer states: “This is a rough draft. Changes will be made. Speculation based on information in this document is at own risk.” That being said, some adjustments may come, but as time passes, the community understands better how everything works, the reasons behind certain choices, and the vision behind X1 and the XEN ecosystem as a whole.

The ERC-20 VMPX mint can be tested here https://test.getvmpx.com/x1