Every crypto investor would love to be in the position of the early Bitcoin miners or holders of meme coins like SHIB or DOGE. It took bitcoin 13 years to reach its all-time high of $69k, but it took Shiba Inu just one year to create many multimillionaires around the world. Every founder is trying to replicate the success of these coins, but do they have what it takes to become the next most wanted crypto asset and actually not fail afterwards? After many iterations, XEN Crypto is the right answer, and here is why.

The SHIB moonshot

Shiba Inu was launched in July 2020 when Ryoshi created a total supply of a staggering 1 quadrillion tokens with one click of a button. This number looks like this: 1,000,000,000,000,000.

On August 1, the price was $0.00000000051. $100 would have bought you 196,078,431,372 SHIB.

495 trillion of the total SHIB was locked in a SHIB/ETH liquidity pool, and 505 trillion was sent to Vitalik Buterin.

The daily trading volume was in the thousands of dollars for months, and it spiked to $26 million in January 2021. Two months later, it had a market cap of $1.28 million and 13000 users, but when Elon Musk tweeted about it in March, the price and number of holders began to rise.

I’m getting a Shiba Inu #resistanceisfutile

— Elon Musk (@elonmusk) March 14, 2021

Another month and a tweet from Jordan Belfort, aka the Wolf of Wall Street, sent the market cap to $535 million and the holders’ number to 100k.

SHOW ME THE SHIBA INU

— Jordan Belfort (@wolfofwallst) April 20, 2021

At that point, the price had dropped four zeroes to $0.000004058, making your $100 of SHIB worth $795,686. The holders continued to grow, reaching 200k in May and $10 billion in market cap. Listings from exchanges like Binance, BitForex, and Kucoin deleted one more zero from Shiba Inu’s price, making your $100 dollars worth $7 million.

It was then that Vitalik Buterin decided to donate $50 trillion, or 5% of the total supply of SHIB, to India’s COVID Relief Fund. After a 44% drop and criticism from the community, Buterin decided to burn 410 billion SHIB.

In July, Shopping.io introduced SHIB to its platform, letting users buy from Amazon, eBay, and Walmart, but soon after the market cap dropped by 90%.

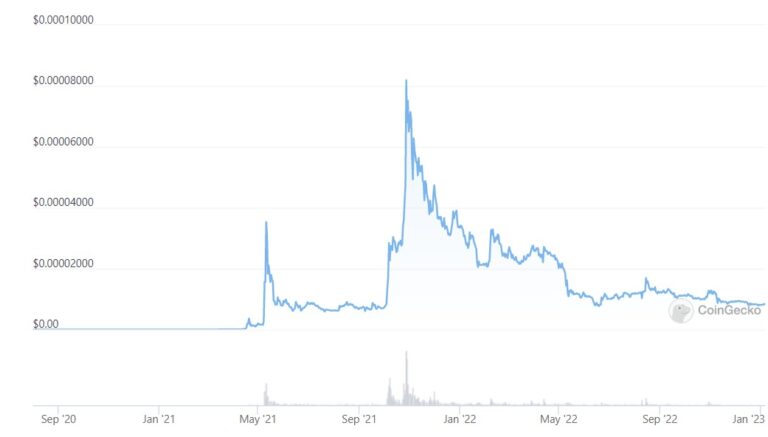

When Coinbase listed SHIB, the market cap rose again to $20 billion. In the meantime, new Shiba Inu related tokens, LEASH, BONE, were created and launched on ShibaSwap. In October, the price reached an ATH of $0.00008845, with a $32 billion market cap, and your $100 was worth $17,343,137.

Why did Shiba Inu get so popular

Despite having no utility and an enormous supply, SHIB attracted investors willing to make fun of the other meme coin, DOGE. The barrier to entry was so low that even after price spikes, Shiba Inu was one of the cheapest coins on the market.

The involvement of Vitalik Buterin and tweets from Elon Musk and Jordan Belford were crucial in driving attention to the token, bringing in new users and listings on huge exchanges. The exchanges improved liquidity and opened the gates to even more users; however, this resulted in significant price drops.

The launch of ShibaSwap, LEASH, and BONE instead brought utility to the token, as now there was something to do with it and it could be held onto for more time. Real world adoption as a payment token followed suit but wasn’t enough to stop the price from falling.

It’s obvious that what drove the price of SHIB up was FOMO more than anything else, and it’s interesting to iterate on how it evolved. The social, not the intrinsic, properties of the token and its tokenomics were what drove value.

Can XEN Crypto compete with SHIB

XEN Crypto and SHIB have both 18 decimals, and while the price of SHIB at launch was barely $0.00000000051, that of XEN opened at $0.006148 and traded with a $32 million volume from the start. To put it into perspective, it took SHIB eight months and Elon Musk’s tweet to get to this volume.

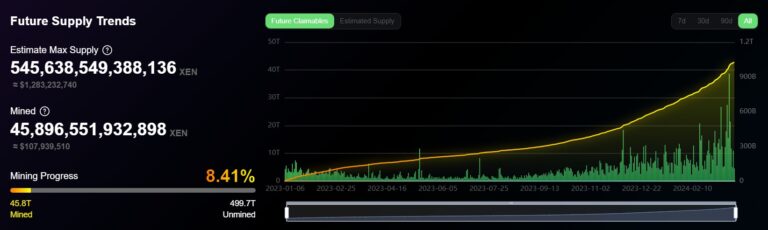

The maximum supply of SHIB is 589 trillion dollars, and the maximum supply of XEN is expected to be 545 trillion dollars in 8 years. After barely 89 days, XEN Crypto is already in the lead with respect to what SHIB did.

XEN’s price is currently $0.000002321, and that of SHIB is $0.000008558. The market cap is where the whole difference stays because that of Shiba Inu stays at $5 billion while that of XEN is $6.6 million for the current 2,914,433,546,505 XEN supply. This only means that XEN has some work to do, but comparing the metrics, the foundation of XEN is more stable than that of SHIB.

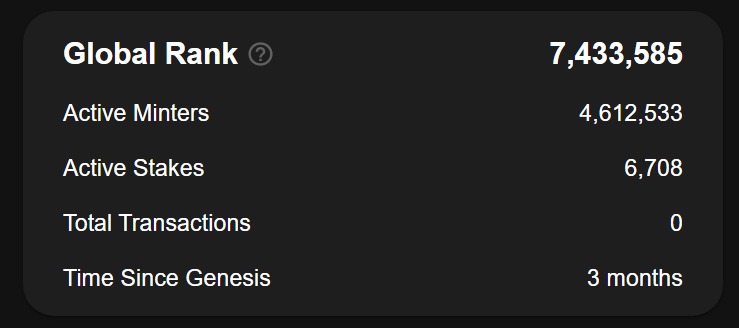

The SHIBA Inu community counts 1,276,704 holders, and that of XEN Crypto has 47,726 holders on Ethereum, which doesn’t reflect the real number. There are 4,612,533 active minters and 6,708 stakers. Active minters and stakers are not counted as holders by Etherscan because they don’t have XEN in their wallet yet or they had it and now it’s staked. These users become holders at the moment their mint term or stake ends, and they claim or unstake XEN. Within the maximum of 442 days, all these minters will become holders, which means there will be more XEN holders than SHIBA holders within a short period of time and without any tweet from Elon Musk or a prominent crypto influencer. The truth is that even if they don’t figure on Etherscan’s radar yet, they are already a part of the XEN community.

Someone may object, saying that the active minters are just Ethereum addresses and not real people. Jack Levin, the founder of XEN Crypto, showed Google Analytics statistics multiple times showing the number of unique users coming to the official xen.network website to mint XEN. What’s more, the numbers reported by Google Analytics stats don’t account for other third-party XEN minters whose activity is visible on Etherscan instead, which means that the number of real users reported by Levin is even higher. XEN is also available on nine other networks, which means that the communities minting XEN on all those chains are also part of the XEN ecosystem but aren’t included in the statistics.

Users who found $XEN in their life, not including all the traders who discovered it on many different trading platforms… pic.twitter.com/f8wBov9GRP

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) January 4, 2023

#XENCrypto Top 25 countries (launch to date):

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) December 17, 2022

(https://t.co/7oDUapv3J4 webapp only, excluding bulk minters) pic.twitter.com/McoV7PFcVb

The exchanges played a big role in making SHIB popular and granting access to an even greater audience. XEN is already on exchanges like Huobi, Gate.io, MEXC, and Poloniex. They provide liquidity and facilitate entry into XEN Crypto. It will be interesting to see how the listing on Binance, Coinbase, or Bitfinex affects XEN. On November 3, XEN registered a trading volume of $100 million, which is a pretty good result for a free-to-mint token launched not even one month before.

Because of the low cost per unit, Shiba Inu was able to attract a large number of customers. It proved that mad gains can be made with a very tiny investment. The fun aspect of mocking Dogecoin was surely useful for spreading awareness, but was it enough for someone to make a buy order? XEN Crypto has an even lower barrier to entry because it’s free to mint, and one mint for the maximum term can give you around 33 million XEN. You don’t need to invest that $100 to get the tokens that earned SHIB holders $17 million. If the barrier of entry is what granted SHIB the moonshot, then with its free entry, XEN should make it to Mars.

Gas is the fuel for XEN

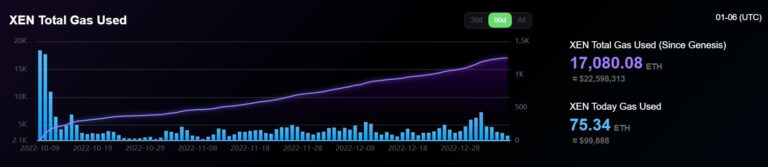

The best way to observe XEN activity is to look at the consumption of gas. To mint XEN, the user needs to pay for gas, which is mostly burned. Gas is thus a great indicator of XEN minters’ activity. We can observe that when gas is low, there are more mints. When gas is high, the activity goes down. XEN minting is a rhythmic process that is powered by gas and carried out by XEN minters. Total gas used to mint XEN is 17,080.08 ETH, equivalent to $22,598,313. The burning of gas made Ethereum deflationary, which potentially protected the ETH price from a further fall in this bear market. Since XEN’s value depends a lot on the price of gas, which is dependent on the price of ETH, it can be assumed that the value of XEN will grow along with it; however, the accuracy of this assumption will be asserted in the future. To this day, the proponents of Bitcoin are debating if it’s the price of bitcoin driving the hashrate upwards or if it’s the hashrate driving the price. XEN minters are like Bitcoin miners and burning gas is like using electricity to mine.

XEN is a different animal

Unlike XEN or bitcoin, Shiba Inu has no relation to gas or electricity consumption. The 1 quadrillion supply was born in an instant when Ryoshi pressed the button. In XEN’s supply existence, there’s the hardship of every minter coming to the network, connecting their wallet, and minting XEN by burning gas, waiting for it to finish, and then coming back to make a claim. There’s time, effort, gas money, and the entire community going into the active creation of the XEN supply. It’s the XEN minters deciding collectively how much they value their effort and time. If they value it a little, then they’ll sell it for next to nothing, if they value it a lot, then the price will grow.

XEN is similar to SHIB in the virality factor, but it’s more similar to Bitcoin in the way it works. Jack Levin himself admitted that he wanted to create something like Bitcoin on Ethereum, which is why the supply starts at zero and is created gradually in the minting process simulating mining. In XEN’s algorithm formula, there’s also a time factor, minting difficulty, and a rewards amplificator working as a cap on the supply. The supply isn’t fixed, but after 3000 days since Genesis, the inflation will remain at a constant 2%. With the launch of XENFTs and other projects burning XEN, it’s very possible that the supply will become deflationary.

The main difference between XEN and SHIB is that XEN is entirely created by the people who decide to connect their wallets and mint XEN. There’s no one person, not even Jack Levin himself, who has a massive influence on the XEN supply’s creation or its fate. There’s no Ryoshi who can lock 500 trillion tokens in a liquidity pool or who can send 500 trillion to Vitalik Buterin, who can then dump or burn them. There’s no CEO, CMO, COO, CFO, or any other officer behind XEN, and not a single point of failure is deciding its destiny. XEN is a grassroots movement where everyone can be Satoshi Nakamoto, and this is where its strength is.

#xendoge (retweet) pic.twitter.com/mqggTI6pkp

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) December 21, 2022

Conclusion

The early signs show XEN Crypto’s superiority to SHIBA Inu. While SHIBA’s value peaked at $20 billion, it quickly plummeted to $2 billion due to the lack of real value in it other than a few tweets. There was no time and effort involved in its creation, however, the SHIB community did a great job in creating an ecosystem where the SHIB token could thrive. In the 89 days since Genesis, different developers gathered around XEN to create projects and useful tools for the community. The Fair Crypto Foundation created XENFTs and the XEN Torrent protocols, which facilitate the minting process by burning the XEN supply and giving utility to the token. XEN managed to be in a better position than SHIB in a very short time, and it is still overlooked by many. This is an opportunity for those who mint now, as they will receive more rewards, similar to how Bitcoin miners were rewarded for mining early.