The XEN Crypto price has been tanking since launch and is finding lower all time lows. Liquidity is one of the main issues with all kinds of XEN tokens on different chains. Despite that, its market cap is steadily growing and reaching new highs, and the community is expanding like wildfire. After XENFTs, Staking XENFTs, NEX, X1, and Devnet, Jack Levin is now working on a new idea that will help XEN’s liquidity. The former Google engineer wants to create Liquidity XENFTs fuelling Uniswap V3 LP positions to support the floor price and improve price stability creating de facto what can be described as a decentralised exchange.

XEN price criticism

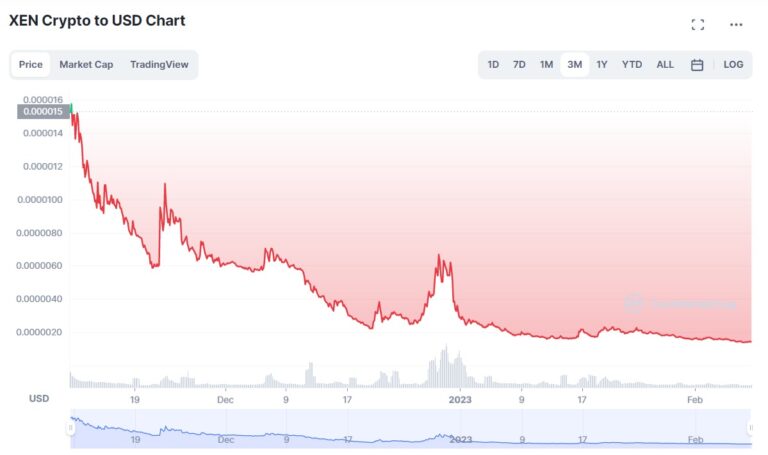

Since its launch on October 8, XEN Crypto has been experiencing a downward trend and lots of criticism for its constantly increasing supply. The launch of XENFTs provided a short-term spike in price, but it’s been followed fast by a sharp fall. After the pre-launch hopium however, the price seems to have eventually found what would seem like a floor because it’s been oscillating between $0.0000030 and $0.0000013 since January 1.

The market cap in turn has been steadily growing and is currently at $8,512,204, while the daily trading volume is $1,335,562.

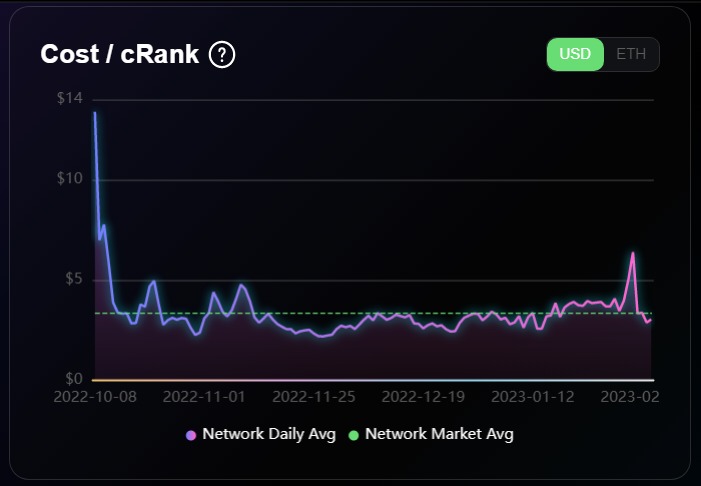

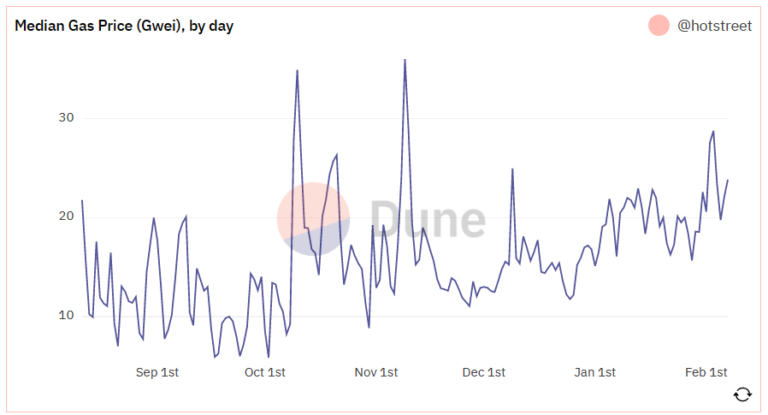

Since XENFTs’ launch, the cost of cRank has grown because of the increasing median gas price.

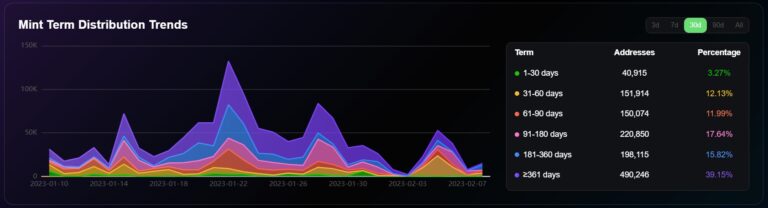

Because of the increased cost of cRank, the mint term length has also changed significantly. At the start, most of the mints were short-term. Now that the median price of gas (24.83 gwei) has grown 3x since September (8.25 gwei), it’s no longer profitable to mint short-term, and most of the mints are at least 90 days into the future.

So far, the XEN minters have burned 25,178.60 ETH equal to $42,037,439 USD.

For months, the smart contracts that generate XEN have been among the top gas guzzlers. There’s some correlation between rising cRank and the price flattening in the last week. Less people are willing to sell XEN at lower prices and Staking XENFTs together with the prospects of NEX, FENIX, X1, and now also Liquidity XENFTs make this choice even more difficult. With so much contracts focusing on burning XEN, it would seem like high inflation will be soon the thing of the past and the price may change the trend upward.

XEN liquidity

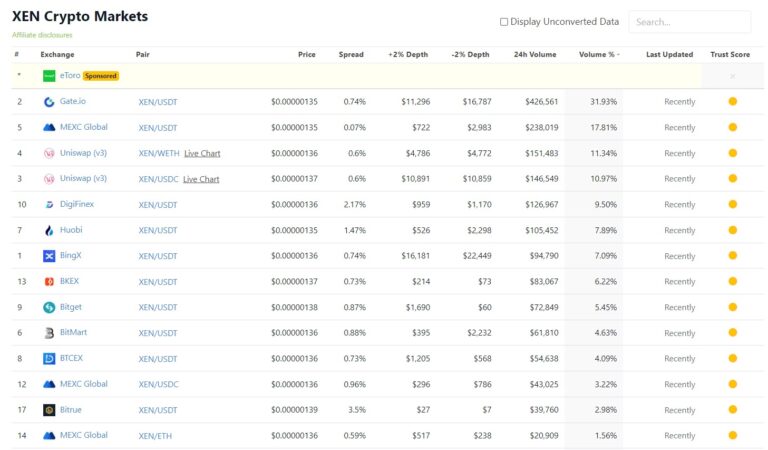

XEN is a token that was minted entirely by the community members, and there wasn’t allocation to the founders or VC investors. Because there was never any allocation to a central party, the liquidity was low for the most part, however, some centralized exchanges like Gate.io or MEXC managed to provide a relatively good level of liquidity by attracting depositors in different ways.

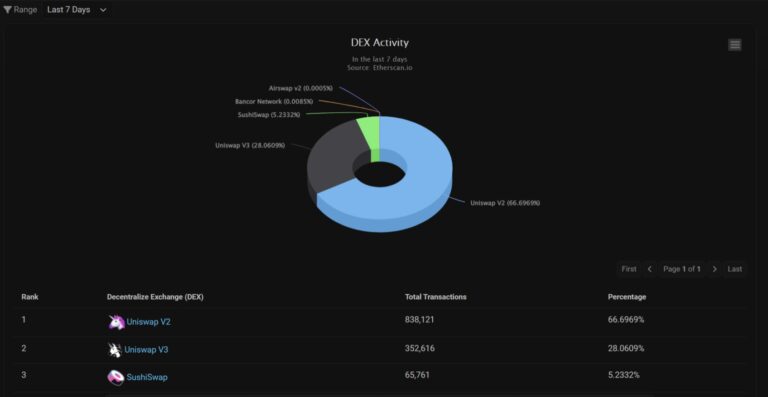

Uniswap V3 liquidity is the highest among all DEXes. Uniswap V3 is an upgraded version of Uniswap V2 and the second DEX with the most transactions.

Uniswap V2 has distributed liquidity, and LPs often don’t earn enough from the fees. Uniswap V3, in turn, features concentrated liquidity and multiple fee tiers, which make more efficient use of capital in price ranges where the actual price is most likely to be.

Anyone can create a liquidity pool on Uniswap V3, and concentrated liquidity gives users more control over the price ranges they prefer. Individual positions are then aggregated together into one pool, allowing users to trade against one combined curve. LPs can choose between multiple fee tiers to be compensated adequately for their risk. A user can create many LP positions within a single pool.

Uniswap V3 users trade against the combined liquidity of all individual curves, and the trading fees collected at a given price range are split pro-rata by LPs proportional to the amount of liquidity they contributed to that range.

On Uniswap V3, LPs can trade assets by adding liquidity to a price range entirely above or below the market price.

The improvements made in Uniswap V3 let LPs use capital more efficiently and trade assets with low slippage.

These improvements are very good and help incredibly low-liquidity tokens. XEN, on the other hand, is a unique type of token. It’s completely decentralised and it’s a minting token which means that its supply is being brought into existence as we go rather than having been created and allocated by a centralised entity like a founder.

One quadrillion SHIB have been created with the click of a button and then burned, donated, and locked by their founder. All the tokens are created this way, that’s why they may be considered securities. They’re also not decentralized in nature.

Jack Levin chose the path of the first principles of blockchain and made XEN in the image of Bitcoin which also went through the same process of hyperinflationary phase followed by increasing difficulty and scarcity. This means that while XEN is in initial stages, there are those seeking quick profits by selling it off and lowering the price. Increasing liquidity means that the price will be more stable, however XEN’s liquidity needs to be provided organically by individuals minting their tokens rather than being allocated by the founders. This process takes time because individuals need to understand how to create an LP and generate profit from providing liquidity.

liquidity XENFTs

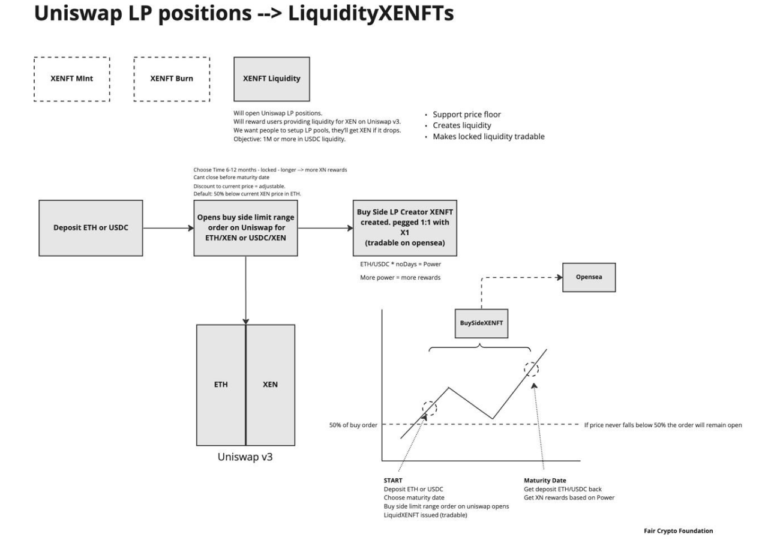

Jack Levin’s latest idea is to create Liquidity XENFTs to establish a floor price and create incentives for LPs.

Users will be able to provide ETH or USDC liquidity through a web app. They’ll need to specify a time frame ranging from 6 to 12 months to lock in their liquidity. Early unlocks aren’t possible. A deposit of ETH or USDC into a LP automatically opens up a buy side limit range order for ETH/XEN or USDC/XEN at a price that is 50% lower than the price at the time of LP XENFT creation.

It often happens that a pool goes out of range if it’s too tight. The LP isn’t then earning any fees, and when this happens, the LP is composed of the token with the lower price, which in this case would be XEN. When the price returns to the range, LPs can earn fees again.

If ETH or USDC LP are in range, the limit order remains open, but when the price falls by 50% from the current price, the order will get executed and the XEN buy happens. This has a positive effect on the XEN price and serves as support for the floor price.

Liquidity XENFT holders will gain Power convertible to the XN token at a 1:1 ratio that will be given when the X1 testnet launches. The Power formula is as follows:

Invested amount * number of days = Power

These LP XENFTs are tradeable on OpenSea, which means that even if ETH and USDC can’t be unlocked before maturity, it’s still possible to sell a LP position to someone else, so it effectively becomes a decentralized exchange. The holder of the LP XENFT has the keys to unlock the deposit, the fees, and the rewards within it.

When the LP XENFT reaches maturity and the buy order hasn’t been executed, ETH and USDC can be withdrawn together with the earned fees and XN rewards based on Power. Power can be increased by increasing the pledged amount of ETH or USDC, increasing the lock-up time, or both.

conclusion

Taking on a leveraged position in a liquidity pool through capital concentration in a tighter price range means higher capital efficiency and fees earned, but it also means a higher risk of impermanent loss. This can be potentially offset or superseded by choosing broader price ranges, the XN rewards, and the high fees earned while in range.

The scope of liquidity XENFTs is to support the XEN price floor and build deep liquidity for the ETH/XEN and USDC/XEN trading pairs. A deeper liquidity pool stabilizes the price and reduces slippage, which attracts more capital. It reduces volatility, which can be positive or negative depending on which side someone stands on. Overall, minting LP XENFT may be a good strategy for someone who wants to buy XEN at a low price while earning trading fees.

Including an option for burning the LP XENFT when it goes out of range to gain NEX and additional XN tokens is something that could attract more liquidity providers, creating an efficient DEX.