Ordinals have been introduced to Bitcoin just recently and have been shaking not only the Bitcoin community but also the Ethereum community. NFTs on Bitcoin aren’t new, but the recent taproot softfork and ordinals have opened up new avenues. Jack Levin decided to take the opportunity and put XEN Crypto on the Bitcoin blockchain. The new project called XENtoshi is already in development, and its launch will add Bitcoin as the 11th chain to the XEN ecosystem.

what are bitcoin ordinals

The Ordinal theory has been conceptualized by Casey Rodarmor, the Bitcoin core developer. Ordinals are nothing more than serial numbers for each satoshi. Satoshis or sats are transferred from transaction inputs to transaction outputs on a first-in-first-out (FIFO) basis. Each bitcoin has 100 million satoshis. There is 2,099,999,997,690,000 satoshis in total. The numbering started at zero with the first block reward, and it will continue as long as the last Bitcoin block is mined, which is set to happen in 2140. There are 21 million bitcoin in total, with 91.9 percent, or 19.3 million, already in circulation. There are just 1.7 million left, and they’re being injected into supply at a rate of 6.25 BTC per 10-minute block, or 900 BTC per day. The hard cap on the total supply and the difficulty in changing it make Bitcoin the scariest asset on Earth.

Ordinals are essentially a numbering scheme and don’t require any changes to blocks, transactions, or network protocols. They have a lot in common with inscriptions, which are the equivalent of Ethereum’s NFTs, but they’re fully on-chain.

Because Bitcoin has cyclicity all over, like 10-minute blocks, halvings every 4 years, difficulty adjustments every 2016 blocks, and conjunctions occurring roughly every 24 years, Casey Rodarmor decided to create a rarity score for each ordinal based on these cycles.

- common: Any sat that is not the first sat of its block

- uncommon: The first sat of each block

- rare: The first sat of each difficulty adjustment period

- epic: The first sat of each halving epoch

- legendary: The first sat of each cycle

- mythic: The first sat of the genesis block

More on different rarity scores can be read here.

Ordinals seem to have certain aspects in common with XENFTs. They are both connected to NFTs, they have a rank and rarity embedded all over them, and they’re divided into categories based on rarity.

what are bitcoin inscriptions

While ordinals are a way of numbering single satoshis, inscriptions are what can be written into them. It’s possible to inscribe arbitrary data like images, text, videos, javascript, HTML code, and others. The content is written on a sat and revealed on-chain. It’s linked to that sat forever, and it becomes an immutable digital artifact that can be tracked, transferred, hoarded, bought, sold, lost, and rediscovered.

The main difference between Bitcoin inscriptions and Ethereum NFTs is that inscriptions are on chain and can’t be deleted, while Ethereum NFTs are stored off-chain and it’s difficult to know where they are stored. It could be IPFS or someone else’s server. This is what makes inscriptions desirable.

XNEFTs are also unlike other NFTs. XENFTs are not .jpeg images stored off-chain like BAYC or Punks. XENFTs are .svg stored fully on the Ethereum chain. As soon as ordinals went live, some BAYC owners decided to burn their monkeys on Ethereum and inscribe them on the Bitcoin blockchain. It’s believed that such an early and arduous move will pay off in the future.

Ordinal NFT of myself and mr. Larry Page (of Google) on the Bitcoin blockchain inscription: https://t.co/LLl1c3KohS pic.twitter.com/18mtTQDszx

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 15, 2023

Inscriptions can be very large and can even take a full Bitcoin block, which is 4 MB. Buying the full bitcoin block space, however, means having to pay a high transaction fee.

#xenducation BTC lift-mode w @mrJackLevin pic.twitter.com/ER7wbbMudm

— XEN TZU 🟧🦇🟦 (@ackebom) February 16, 2023

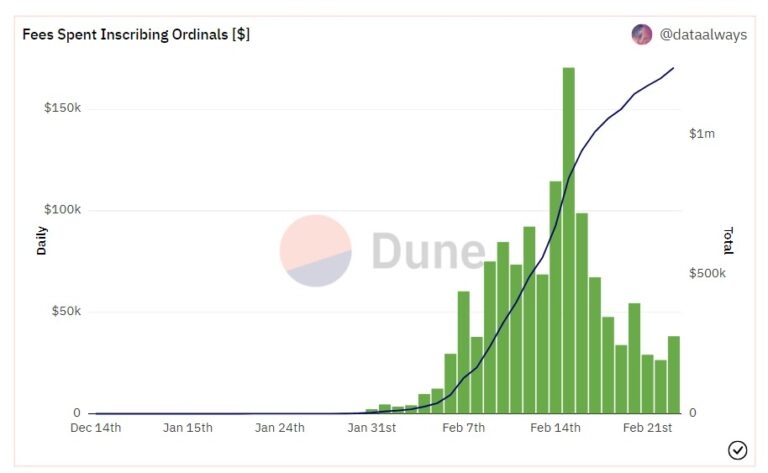

Right now, the transaction fees on Bitcoin are lower than on Ethereum. Ordinals could bring a higher demand for the block space and raise the fees, which would make it more profitable for the miners to continue securing the blockchain.

what is xENtoshi and XENOrdinals

XENtoshi is the new Fair Crypto Foundation project that will bring XEN to Bitcoin. Jack Levin posted on Twitter a draft delineating the mechanics.

Bitcoin Blockchain - We are coming - $XEN pic.twitter.com/qH7c5a4Z1c

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 16, 2023

Design - XENOrdinals pic.twitter.com/Fn5yHGm0Qf

— ⓧ Cyphereus Prime 🟧🦇🟦 (@mrJackLevin) February 20, 2023

Most of the mechanics will take place on Ethereum, and the XENtoshi contract will connect Ethereum to Bitcoin. The XEN minters on Ethereum will need to stake XEN. Staking XEN indicates that it has been burned from the XEN supply. A user needs to provide a Bitcoin taproot address and the transaction ID with proof of staked XEN. The XENtoshi contract will then inscribe the NFT on Bitcoin and send the XENOrdinal inscription to the provided address.

The XEN stake has a staking period, and when it reaches maturity, it will be possible to bring the inscription back to Ethereum and mint XEN.

The user can also sell the XEN stake on Bitcoin, and the new owner will be able to redeem it on the other side.

It’s possible that XEN, being a monetary asset and not an image, will spark a new kind of DeFi on Bitcoin. It surely is unique, as there are no other tokens on Bitcoin yet, and XEN becomes the de facto pioneer in this space.

The XENtoshi contract will have a network of Bitcoin virtual nodes running on virtual machines, which will be able to inscribe data quickly for all users. Virtual nodes will interact with Ethereum through an RPC bridge like Infura, Alchemy, or Quicknode.

Jack Levin said that this solution is necessary because Bitcoin wasn’t designed with the thought of having multi-user applications besides transactions. Bitcoin nodes can inscribe one instance at a time, and the need for virtual nodes is needed to sustain the load that will come from the XEN users.

When XENtoshi will be ready, first 10.000 XENOrdinals minted by the community will be special and of a collectible value.

controversy

Bitcoin is an uncensorable global broadcast network. With its limited supply and block space, it’s possibly the scarcest asset on Earth, and having an inscription on Bitcoin may become very valuable.

After an initial hype, the number of inscriptions seems in decline.

An interesting thing is that an inscription can have other inscriptions written on top of it, and different inscriptions can be concatenated. We may see times when one Bitcoin block is mostly filled with just one inscription. It already happened but it remains a sporadic event for now.

This, however, means that Bitcoin will transition from peer-to-peer cash to an art gallery, with monetary transactions shifting to off-chain solutions such as the Lightning Network or sidechains.

Transacting on chain could become prohibitive, and even opening a LN channel may be expensive.

The Bitcoin community is divided on the topic of inscriptions, but they are staying to watch what happens next.

The miners have an interest in mining inscriptions because this would create a whole new fee market and more revenue for them. Luxor Mining is has already bought an NFT marketplace to facilitate the exchange of inscriptions. It’s a clear signal that this miner is in support of NFTs on the Bitcoin network.

XEN on Bitcoin, however, is a whole new thing. It’s been created in the image of Bitcoin, and it’s the only crypto that had a fair launch with no pre-mine and no admin keys, that was minted entirely by the people at large and that has been successful in gathering community support. It’s present on 10 chains so far, and Bitcoin will be the 11th one. It’s difficult to know how XEN is going to be received, but it may bring some enthusiasm from that part of the community that wants to participate in DeFi while remaining on Bitcoin.